Elliott Wave Cycle Detailed Explanation Sweeglu

3) Motive Waves 3.1 Impulse 3.2 Impulse with extension 3.3 Leading Diagonal 3.4 Ending Diagonal 3.5 Motive Sequence 4) Elliott Waves Personality 4.1 Elliott Wave 1 and wave 2 4.2 Elliott Wave 3 4.3 Elliott Wave 4 4.4 Elliott Wave 5 4.5 Elliott Wave A, B, and C 5) Corrective Waves 5.1 Zigzag 5.2 Flat 5.2.1 Regular Flats 5.2.2 Expanded Flats

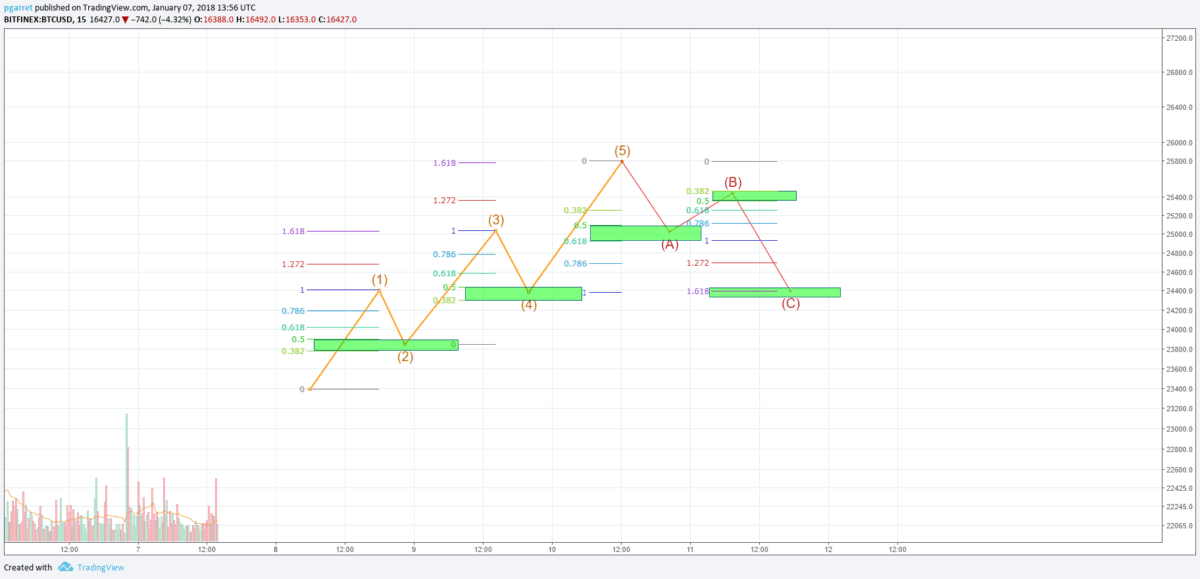

Elliott wave theory Example using actual Forex charts

Amanda Jackson What Is the Elliott Wave Theory? The Elliott Wave Theory in technical analysis describes price movements in the financial market. Developed by Ralph Nelson Elliott, it observes.

Elliott Wave Pattern Candle Stick Trading Pattern

The books are written by experts familiar with the work flows, challenges, and demands of investment professionals who trade the markets, manage money, and analyze investments in their capacity of growing and protecting wealth, hedging risk, and generating revenue.

Practical Application of Elliott Wave Theory in Trading R Blog

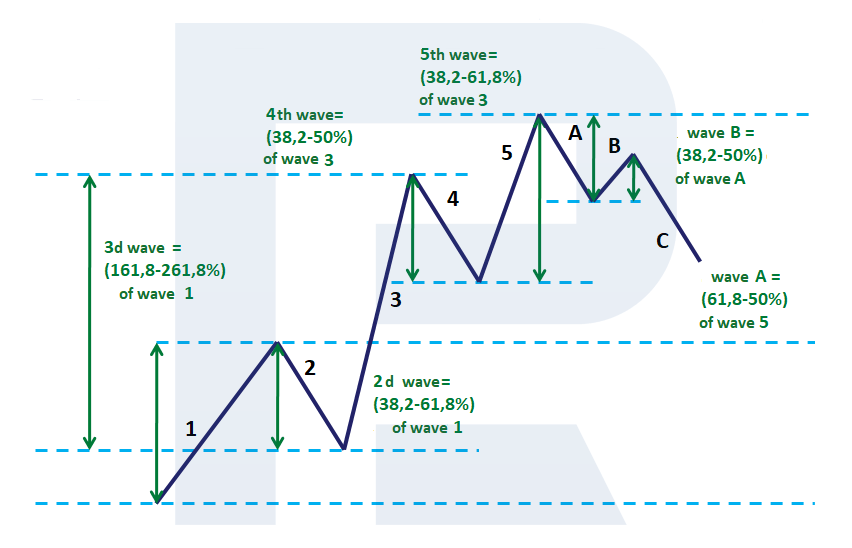

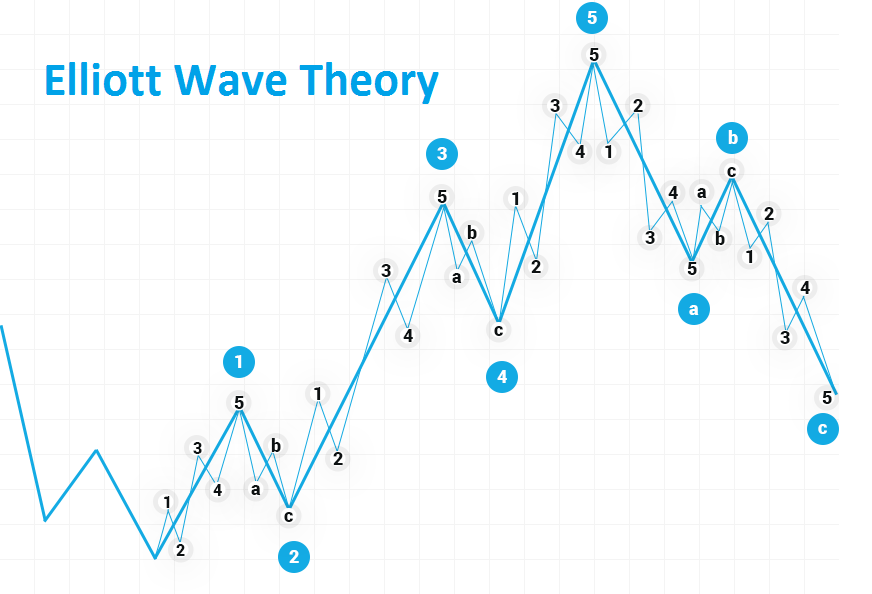

[1] Foundation The Elliott wave principle posits that collective trader psychology, a form of crowd psychology, moves between optimism and pessimism in repeating sequences of intensity and duration. These mood swings create patterns in the price movements of markets at every degree of trend or time scale.

The Elliott Wave Theory Explained CFA Level 1 AnalystPrep

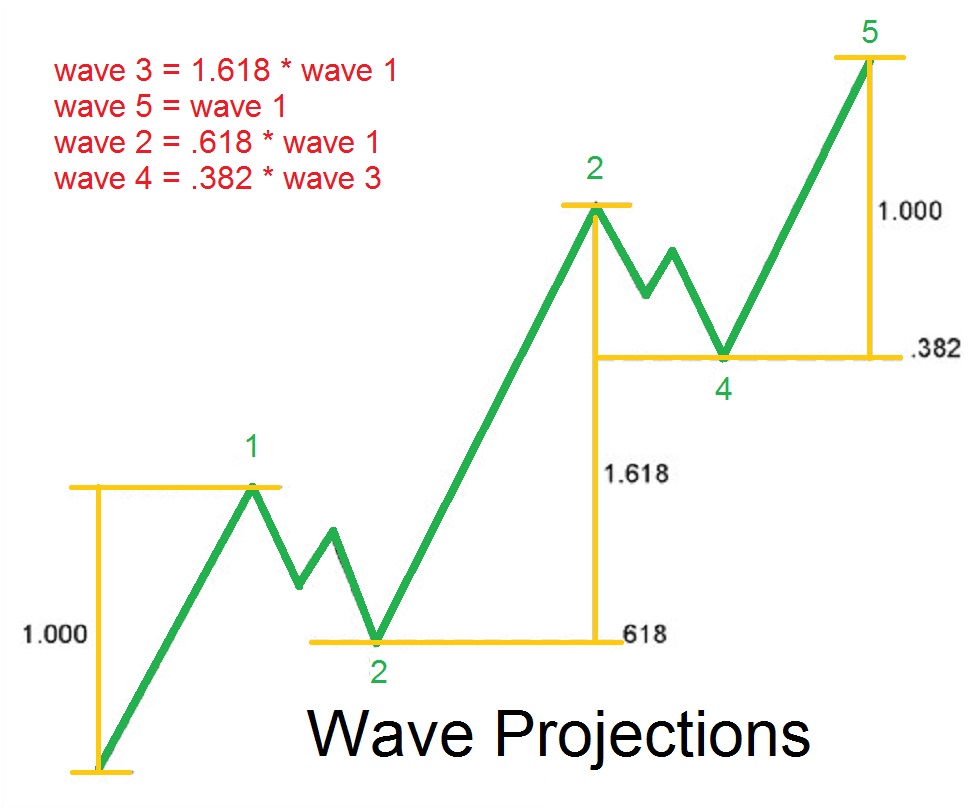

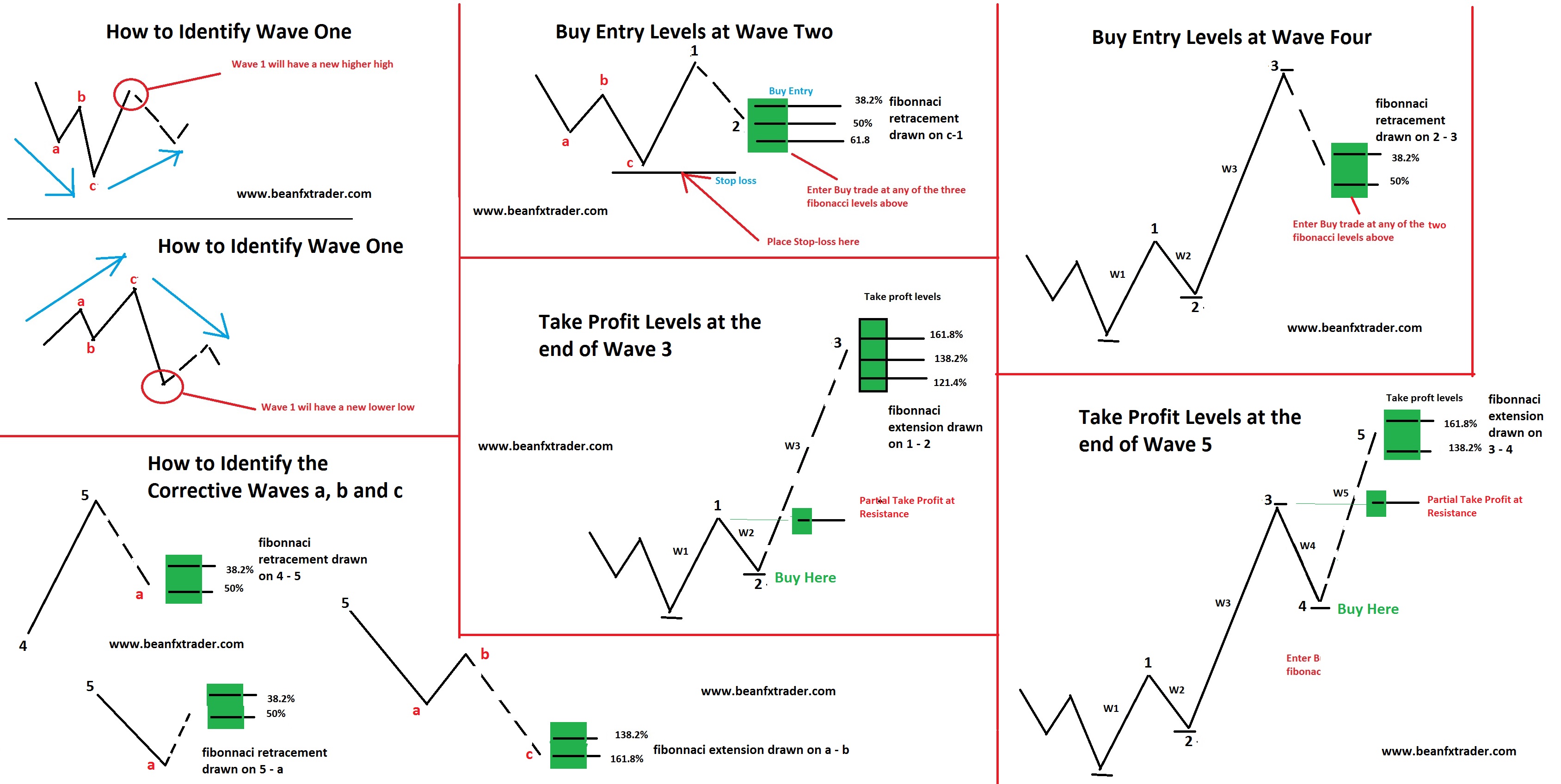

3. 2. Three main rules for impulse waves in Elliott Wave theory There are 3 main rules, which anyone who wants to make an Elliott Wave analysis must know. First rule: Wave 2 cannot retrace the whole wave 1. Second rule: Wave 3 cannot be the shortest among waves 1, 3 and 5. Third rule: Waves 1 and 4 must not overlap. See an example below: 3.3.

Visual Guide To Elliott Wave Trading UnBrick.ID

The chart below shows an example of the Elliott wave. Basic structure of the Elliott Wave. In the naming convention of the Elliott wave theory, price tends to alternate between the impulse and motive waves. The impulse waves which move in the direction of the trend are divided into five lower degree waves. Typically, the waves numbered 1, 3 and.

/elliott-wave-tricks-to-improve-trading-4153295_FINAL-3500ecb730a84818b040c75f73a1fa98.png)

Elliott Wave Tricks That Will Improve Your Trading

Elliott Wave Labels, Trendlines, and Fibonacci Targets: Main and/or Alternate Count. Just below the title (see examples above), indication will be made on whether the main Elliott Wave count only is shown, or both the main and alternate counts. If no indication is made, please assume that the chart depiction is the main Elliott Wave count.

Elliot Wave Theory A Complete Guide For Cryptocurrency Traders

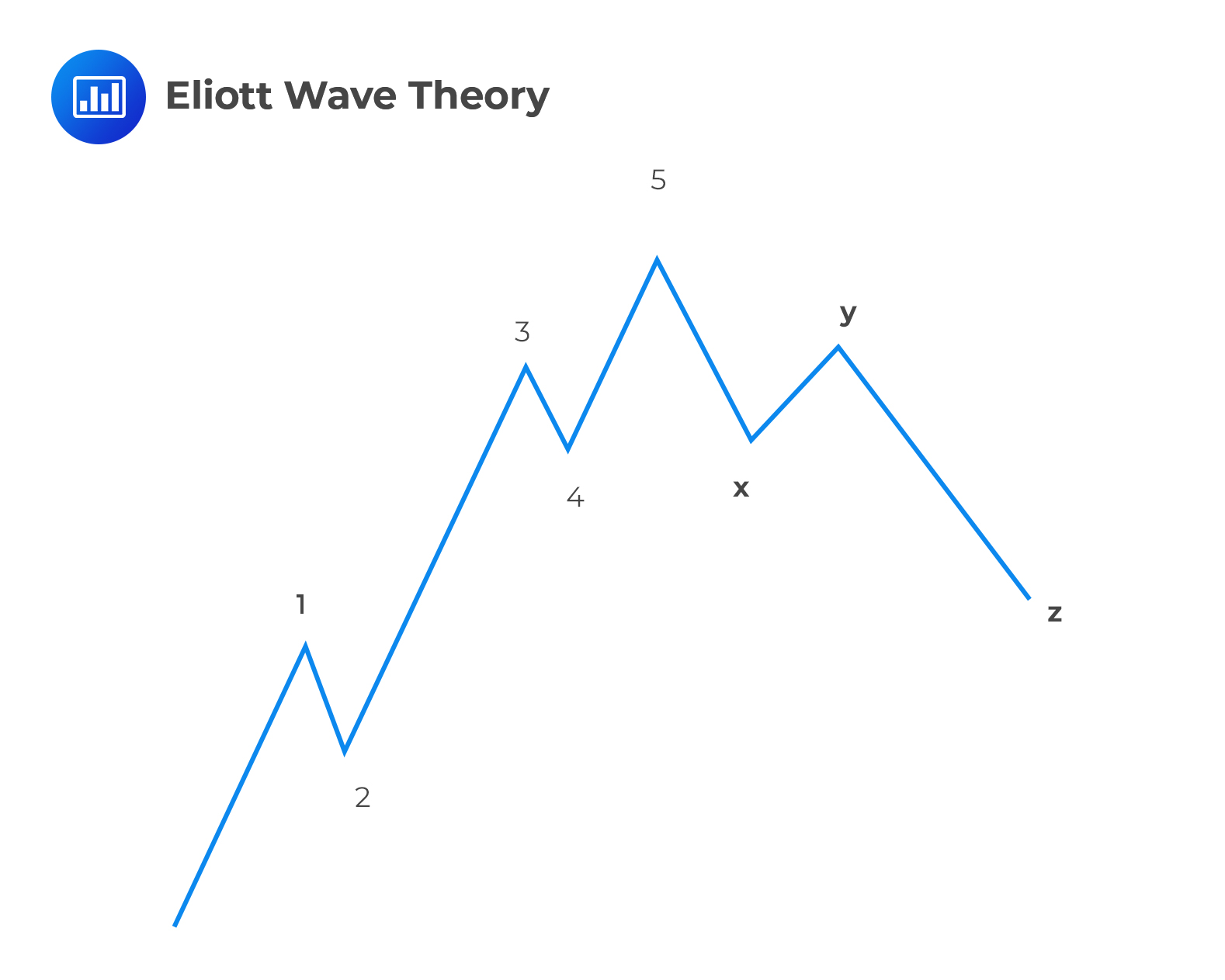

Here's the four types of Elliott Wave Corrective Patterns: 1: ABC ZIGZAG correction wave - 5,3,5 internal wave form. 2: ABC FLAT corrections - 3,3,5 internal wave form, regular and irregular types. 3: TRIANGLE ABCDE corrections - 3,3,3,3,3 internal wave form. 4: COMBINATION corrections - additive structure made from multiple simple corrections.

Elliott Wave Cheat Sheet All You Need To Count แท่งเทียน, แพทเทิร์น

Examples might include housing prices, fashion trends or how many people choose to ride the subway each day. In this section, we will introduce the rules of wave formation and the various patterns seen in Elliott Wave Theory.

5 part Course to Unlock the Power of ELLIOTT WAVE THEORY!

1,764 reviews on Quick link to content: 1. Elliott Wave 2. Elliott Wave principle 3. Elliott Wave examples 4. Elliott Wave corrective patterns 5. Elliott Wave fractals 6. How to start counting Elliott Wave 7. Elliott Wave theory rules 8. Limitations of the Elliott Wave theory 9. How to use Elliott Wave in trading Elliott Wave

Complete Guide To Charting And Trading Using Elliott Wave Getting

The three rules are: Wave 2 cannot retrace more than 100% of Wave 1. Wave 3 can never be the shortest of waves 1, 3, and 5. Wave 4 can never overlap Wave 1. The goal of a motive wave is to move the market. Out of all the various types of motive waves, impulse waves are the best at accomplishing this. The chart above shows an impulse wave.

Understanding Elliott Wave Theory Basics And How To Apply Them

December 6, 2023 Elliott Wave Theory is a technical analysis indicator used to predict price movements in financial markets. It proposes that market trends move in a five-wave sequence in the direction of the main trend, followed by a three-wave counter-trend.

The classic Elliott Wave CastAway Trader

The Elliott wave theory is a technical analysis tool that claims and predicts that stock price movements are primarily in waves rather than simple patterns. It is said to be quite similar to the Dow theory on the common grounds that price movements occur in waves and not just line patterns.

:max_bytes(150000):strip_icc()/ElliottWaveTheory-b46a288b1cfe42c69bdbf3b502849b2c.png)

Elliott Wave Theory Definition

This is the ultimate video about Elliott Wave for beginners.FRACTAL FLOW WEBSITE: https://www.fractalflowpro.com/ (better seen on desktop!)PRICE ACTION COURS.

Elliott Wave Theory Basic

Here's a quick example of the model vs the reality: The Elliott wave model; A real 5 up 3 down pattern in GOLD; And a bearish 5/3 pattern in Crude oil; Also in this guide; I will go through how to use an Elliott wave pattern along with Fibonacci analysis in the forex market, the stock market as well as the commodities market! What you will learn;

ELLIOTT WAVE PRINCIPLE FX & VIX Traders Blog

What examples of successful Elliott Wave trades can be found? There have been several examples of successful trades using the Elliott Wave theory. Some notable examples include: Dow 2002/2003: In 2002, market analyst Robert Prechter correctly predicted that the Dow Jones Industrial Average would fall from its then-current level of around 11,000.